Alternatives to Line 5 are feasible, economically viable, and should be considered by the State of Michigan. Implementation of alternatives would protect the Great Lakes, Michigan’s public inland waterways, our way of life, as well as provide Michigan’s energy needs.

State of Michigan Alternative Analysis

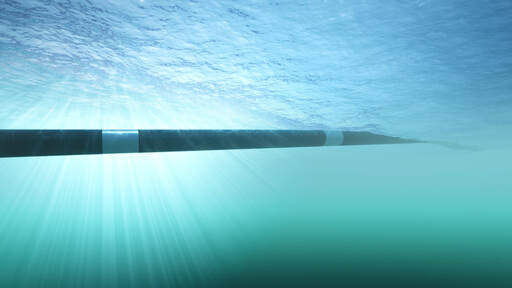

The State of Michigan also conducted an Alternatives Analysis for the 4.6 mile stretch of Enbridge’s Line 5 located in the Straits of Mackinac. The Alternatives Analysis Report was developed by Dynamic Risk Assessment Systems, Inc. The analyses performed include assessments of cost estimates, economic feasibility, socioeconomic impacts, market impacts, and operational risk including the consequences of an oil spill of six different alternatives. The alternatives analyzed were constructing a new pipeline that does not cross the open waters of the Great Lakes, utilizing existing infrastructure, using alternative transportation methods such as rail, road, or vessel, replacing the pipeline, maintaining the existing pipeline, or eliminating the transportation of products through the Straits of Mackinac. The report concluded that all alternatives were feasible options to Line 5 with the exception of utilizing pre-existing pipeline infrastructure, water transport, and truck transport. According to the report, decommissioning of Line 5 would create approximately 2,000 near-term jobs. It would increase gasoline prices by 2-4 cents and would likely increase costs to the refineries in Detroit and Toledo by $0.76/barrel of oil.

The report can be accessed in its entirety on the Michigan Petroleum Pipelines website, www.mipetroleumpipelines.com.

London Economics International Alternatives Assessments

National Wildlife Federation, with funding from the C.S. Mott Foundation, contracted with London Economics International to analyze what the impacts to Michigan would be if Line 5 were to be decommissioned. The reports – summarized below – conclude that Line 5 can be decommissioned without any noticeable or significant economic impact to the State, citizens or businesses. The studies have demonstrated that the cost increases are low relative to typical propane, oil, and gasoline price volatility and would be minimal to industry and consumers.

LEI found that the lowest cost alternative to Line 5 to supply propane to the Upper Peninsula is to either truck product or utilize rail from Superior, WI to Rapid River, MI. The cost impacts to consumers would be “lost in the noise of typical propane price volatility” and would be in the range of $.05/gallon. The impact on the Lower Peninsula “may be negligible”. There would be no likely risk to energy security or long-term propane supply as supply is growing faster than demand in the U.S. The potential small price increase for the Upper Peninsula could, in NWF’s analysis, be easily made up for with a small increase in energy assistance dollars so that Michigan propane consumers wind up with a positive impact from Line 5 decommissioning. The LEI report is the detailed and authoritative source on propane, and directly questions the improper assumptions and calculations in Dynamic Risk’s report, which did not focus on propane alternatives for Michigan.

LEI found that the small volume of Michigan crude oil production that utilizes Line 5 to get to market could utilize trucking directly to Marathon refinery instead. While this could increase costs by approximately $1.31/barrel for northern Michigan oil and less for central Michigan oil. This change is small compared to normal price volatility and “would be lost in the noise of typical crude oil price volatility”. Moreover, if Line 5 were decommissioned, this oil would be in higher demand and, therefore, producers may be able to pass along the cost increase to refineries or other buyers.

LEI found that there is enough excess capacity in other crude oil pipelines to make up for any losses at Detroit and Toledo-area refineries if Line 5 were to be decommissioned. However, downstream users have apportionment rights so the Detroit and Toledo-area refineries would need to supplement current supplies with Michigan-produced crude oil as well as Bakken crude oil delivered by rail. The total cost increase to customers would be a fraction of a cent/gallon for consumers, which would be “lost in the noise of typical weekly gasoline price volatility”.